It’s official – tax season is upon Canadians! The benefits of living in Canada are all the available resources and shared services. These are only possible because of the taxation system, which redistributes wealth. If you’re wondering if you’re required to file your taxes in 2025, continue reading below. Tenace CA Inc., with 10 years of experience as a local Canadian accountant, specializes in providing specialized group services for the financial and tax needs of Chinese enterprises and overseas Chinese companies in Canada. In June 2025, we will open 5 50% discount slots for cross-border sellers, including business and tax landing. For more inquiries, please feel free to contact our tax consultants at any time. We will safeguard your Canadian journey!

加拿大报税季已经正式来临!加拿大这个国家之所以能提供如此多的资源和公共服务,都得益于其税收制度,该制度能够重新分配社会财富。如果您想知道自己是否需要在2025年报税,本文将提供详尽指导及干货助力您的税季顺利前行。Tenace CA Inc., 为本土10年经验加拿大会计师坐镇,专门为中国企业及海外华人在加拿大公司的财税需求提供专项组服务,并且在2025年6月开放5个50%优惠名额针对跨境卖家,包括工商及财税落地,有更多咨询欢迎随时联系我们税务顾问,我们为您的加拿大远行保驾护航!

Part 1: Corporate Tax Filing (T2)

第一部分:企业税务申报(T2)

Who Needs to File a T2?

谁需要申报T2?

All corporations incorporated in Canada, regardless of their business size, profitability, must file a T2 Corporation Income Tax Return. This includes for-profit corporations and non-profit organizations. Even if a company did not operate, was at a loss, or did not have any income during the tax year, it is still required to file a T2 return.

Here are some common types of corporations that need to file a T2:

Corporation: This is the most common type of corporation, where shareholders have limited liability for the company's debts.

Non-Profit Organization: While non-profit organizations are often exempt from income tax, they still need to file a T2 return to report their financial activities.

Cooperative: A cooperative is a business owned and operated jointly by its members and is also required to file a T2 return.

Canadian Branch of a Foreign Corporation: Branches of foreign corporations operating in Canada are also required to file a T2 return.

所有在加拿大注册成立的公司,无论其业务规模、盈利状况如何,都必须提交T2企业所得税申报表。 这包括营利性公司和非营利组织。 即使公司在税务年度内没有运营、处于亏损状态,或者没有任何收入,仍然需要提交T2申报表。

以下是一些需要申报T2的常见公司类型:

股份有限公司(Corporation): 这是最常见的公司类型,其股东对公司的债务承担有限责任。

非营利组织(Non-Profit Organization): 虽然非营利组织通常可以免除所得税,但仍然需要提交T2申报表,以报告其财务活动。

合作社(Cooperative): 合作社是一种由成员共同拥有和经营的企业,也需要提交T2申报表。

外国公司的加拿大分支机构(Canadian Branch of a Foreign Corporation): 外国公司在加拿大开展业务的分支机构也需要提交T2申报表。

What is the Corporate Tax Rate in Canada?

企业所得税税率是多少?

In Canada, corporate taxes are managed by the Canada Revenue Agency (CRA) at the federal level. Think of it as the government’s way of collecting a share of business profits to fund public services like roads, healthcare, and education.

Federal Corporate Tax Rates

General Corporate Tax Rate: The federal corporate tax rate starts at 38%, reduced to 15% after general tax reductions and abatements.

Small Business Tax Rate: The 9% rate applies to active business income up to $500,000 for CCPCs, phasing out for taxable capital between $10M and $ 50 M.

But wait, there is more! Canada’s corporate tax structure is not one-size-fits-all. Each province and territory adds its own tax rate on top of the federal rate. We will discuss this in detail as well.

Provincial and Territorial Tax Rates

Most provinces and territories use a two-tiered tax system:

Lower Rate: Applies to income eligible for the federal small business deduction. Some regions use the federal business limit (the Maximum limit is $500,000), while others set their own.

Higher Rate: Applies to any other taxable income.

What About Quebec and Alberta?

These two provinces like to do things a bit differently; they do not have tax agreements with the CRA, so their corporate tax systems run independently.

In short, if you are running a business in Canada, understanding the corporate tax rate in Canada means looking at both the federal rate and the specific rules in your province or territory.

在加拿大,公司税由加拿大联邦税务局(CRA)管理。可以把它看作是政府收取部分商业利润来资助道路、医疗保健和教育等公共服务的方式。

联邦公司税率

一般公司税率:联邦公司税率从38%开始,在一般减税和联邦减税后降至15%。

小企业税率:9%的税率适用于CCPC (抵扣上限为50万美元) 的活跃业务收入,逐步取消1000万至5000万美元的应税资本。

但是公司的综合税率并不止于此,还有更多内容!谨记加拿大的公司税结构并非一刀切。每个省和地区都在联邦税率之上增加了自己的税率。我们也将对此进行详细讨论。

省和地区税率

大多数省份和地区采用两级税制:

低税率:适用于符合联邦小企业扣除条件的收入。一些地区使用联邦商业限额(最高限额为50万美元),而另一些地区则自行设定。

高税率:适用于任何其他应税收入。

魁北克和阿尔伯塔省的情况

这两个省喜欢做一些与众不同的事情;他们与CRA没有税收协议,因此他们的公司税收系统是独立运行的。

简而言之,如果您在加拿大经营企业,了解加拿大的公司税率意味着要查看联邦税率和您所在省或地区的具体规定。

Key Deadlines

关键截止日期

There are two important dates that all corporation owners need to be aware of in terms of tax reporting: the filing deadline and the payment deadline.

One common confusion is the difference between filing and payment due dates. The payment deadline often occurs two or three months after your year-end, depending on your corporation’s status:

CCPC Under $500,000 Taxable Income: Usually three months after year-end.

Other Corporations: Typically two months post-year-end.

Don’t mistake these for the six-month T2 filing window. You might have to pay before you file. Missing payment deadlines triggers interest, even if you file within six months.

Below are the details of the two important dates:

Filing Deadline: A corporation’s T2 return must be filed within 6 months after the end of its fiscal year. For example, if a corporation's fiscal year-end date is December 31, the filing deadline is June 30.

Tax Payment Deadline:

Canadian-Controlled Private Corporation (CCPC): If the corporation is a CCPC and meets certain conditions, the tax is due within 3 months after the end of the fiscal year. For example, if a corporation's fiscal year-end date is December 31, the tax payment deadline is March 31.

Non-CCPC: For non-CCPCs (e.g., publicly traded companies), the tax is due within 2 months after the end of the fiscal year.

Failure to file or pay taxes on time will result in penalties and interest. Penalties and interest for businesses are generally higher than for individuals.

在税务申报方面,所有公司所有者都需要注意两个重要日期:申报截止日期和付款截止日期。

一个常见的混淆是提交日期和付款到期日期之间的差异。付款截止日期通常在您的年终后两三个月,具体取决于您公司的状态:

应纳税所得额低于50万加元的加拿大控股私有企业(CCPC):通常在年底后三个月。

其他公司:通常在年底后两个月。

切记不要将付款日期与六个月的T2申报窗口期混淆。因为有申报的企业主需要在申报期结束前付款。即使你在六个月内提交了申报,错过付款截止日期也会引发利息。

以下是两个重要日期的详细信息:

申报截止日: 公司的T2申报表必须在财政年度结束后6个月内提交。 例如,如果公司的财政年度结束日期是12月31日,那么申报截止日期就是6月30日。

税款缴纳期限:

加拿大控股私营公司(CCPC): 如果公司是CCPC,并且符合某些条件,税款需要在财政年度结束后3个月内支付。 例如,如果公司的财政年度结束日期是12月31日,那么税款缴纳期限就是3月31日。

非CCPC: 对于非CCPC(例如上市公司),税款需要在财政年度结束后2个月内支付。

未能按时申报或缴纳税款将导致罚款和利息。 企业的罚款和利息通常比个人更高。

Penalties vs Interests

罚金与罚息

The CRA imposes penalties if you miss the Canada tax filing deadline:

5% of unpaid tax right away, plus

1% per month (up to 12 months) of any remaining tax owed.

Repeated late filing in the past three years can double these. Meanwhile, interest accumulates daily on any unpaid balance after the due date.

Penalty is calculated on the tax you owe if the return is past the deadline. Whereas interest is charged daily on any unpaid balance after the payment deadline. Paying on time prevents the interest, but late filing still incurs penalties. The last day to file taxes in Canada for corporations isn’t necessarily the same as the last day for taxes in Canada (payment date). Therefore, to avoid both, one should set reminders for filing and payment.

如果您错过了加拿大税务申报截止日期,CRA将对您进行处罚:

立即支付未缴税款的5%,另加

每月(最多12个月)支付剩余税款的1%。

在过去三年中,重复的迟交申请可能会使罚金的起算基点翻倍。同时,到期日后任何未付余额的利息每天都在累积。

如果纳税申报表超过截止日期,罚金将根据您所欠的税款计算。相比之下,在付款截止日期后,任何未付余额每天都会收取罚息。按时付款可以防止被追缴罚息,但逾期提交仍然需要缴纳罚金。在加拿大为公司报税的最后一天不一定与在加拿大报税的最后日期(付款日期)相同。因此,为了避免被同时追缴罚金与罚息,企业主应该设置归档和付款提醒。

Key Tax Optimization Strategies

关键税务优化策略

For different types of enterprises, the Canada Revenue Agency (CRA) has also formulated different tax reduction and deduction policies based on their own types and operational situations. Here are some common tax optimization strategies and deductions for reference:

Small Business Deduction (SBD): For CCPC owners, qualifying small businesses can benefit from the SBD, which lowers the tax rate on their taxable income. The first $500,000 of taxable income is subject to a lower tax rate (9% federal + provincial tax).

Capital Cost Allowance (CCA): Businesses can claim Capital Cost Allowance on depreciable assets (such as equipment, vehicles, and buildings) to offset their taxable income. The CCA calculation method is relatively complex and needs to be determined based on the asset's class and depreciation rate.

Shareholder Compensation Strategies: Businesses can distribute profits to shareholders by paying salaries or dividends. The choice depends on the shareholder’s personal tax situation and the business's overall tax planning.

Research and Development (R&D) Expense Credits: If a business engages in qualifying R&D activities, it can claim R&D expense credits to offset its taxable income.

Loss Carryover: Businesses can carry losses back 3 years or forward 20 years to offset their taxable income.

Other Tax Incentives: Individual provinces and territories offer various tax incentives, and businesses can apply for them based on their circumstances.

对于不同类型的企业来说,加拿大税局(CRA)同样根据企业自身类型与运营情况制定了不同的税务减免与抵扣政策,笔者在下文为大家简要归纳了积累常见的税务优化政策以供参考:

小企业抵扣(SBD):对于加拿大控股私有企业所有人而言,符合条件的小企业可以享受小企业抵扣,从而降低其应税收入的税率。 目前,首$50万加元的应税收入适用较低的税率(联邦9% + 省税)。

资本成本津贴(CCA): 企业可以对可折旧资产(例如设备、车辆、建筑物)申请资本成本津贴,以抵扣其应税收入。 CCA的计算方法比较复杂,需要根据资产的类别和折旧率来确定。

股东薪酬策略: 企业可以通过支付工资或分红的方式向股东分配利润。 选择哪种方式取决于股东的个人税务情况和企业的整体税务规划。

研发费用抵免: 如果企业从事符合条件的研发活动,可以申请研发费用抵免,以抵扣其应税收入。

亏损结转: 企业可以将亏损结转到之前的3年或之后的20年,以抵扣其应税收入。

其他税务优惠: 各个省份和地区都提供各种税务优惠,企业可以根据自身情况申请。

Common Errors and Audit Risks

常见错误与审计风险

However, it is important to note that any tax reporting errors related to corporate income tax may attract the attention of the CRA, which in turn may trigger relevant tax inspections. The CRA will audit the company’s tax reporting records for the past three years and hold them accountable for any errors or omissions that may occur. The following content is an overview of the key inspection contents of CRA and possible tax reporting errors that the author has compiled for you:

然而,需要重点引起关注的是,任何与企业所得税相关的报税错误都有可能会引起CRA的注意,继而引发相关的税务稽查,CRA会对该企业过去三年的报税记录进行审计,并对可能产生的错漏进行追责。以下内容是笔者为您整理的,对于CRA重点稽查内容以及可能出现的报税错误的相关概览:

Common Filing Mistakes:

常见申报错漏

Failure to Report Related-Party Transactions: Businesses need to truthfully report transactions with related parties (e.g., shareholders, directors, relatives), such as shareholder loans and relative salaries.

Incorrect Classification of Expenses: Businesses must correctly distinguish capital expenditures and operating expenses. Capital expenditures are expenditures used to purchase or improve long-term assets and need to be depreciated over the asset's useful life. Operating expenses are expenses used for day-to-day operations and can be deducted directly in the current period.

Failure to File T1134 (Offshore Subsidiary Reporting): If a Canadian corporation owns offshore subsidiaries, it needs to file Form T1134, disclosing information about its offshore subsidiaries. Failure to file Form T1134 may result in significant penalties.

Unreasonable Expense Claims: The CRA will review a corporation's expense claims to ensure their reasonableness and legality. Businesses should retain all expense receipts and relevant documents to respond to CRA audits.

Underreporting Income is the most serious tax violation, and it can result in severe penalties and criminal charges.

漏报关联交易: 企业需要如实申报与关联方(例如股东、董事、亲属)之间的交易,例如股东贷款、亲属薪资等。

错误分类支出: 企业需要正确区分资本性支出和经营性支出。 资本性支出是指用于购买或改善长期资产的支出,需要在资产的整个使用寿命内进行折旧。 经营性支出是指用于日常运营的支出,可以在当期直接抵扣。

未提交T1134(海外子公司申报): 如果加拿大公司拥有海外子公司,需要提交T1134表格,披露其海外子公司的信息。 未能提交T1134表格可能面临高额罚款。

不合理的费用申报: CRA会对企业的费用申报进行审查,以确保其合理性和合法性。 企业应保留所有费用收据和相关文件,以便应对CRA的审计。

虚报收入: 这是最严重的税务违规行为,可能导致严重的罚款和刑事指控。

CRA Review Focus Areas:

CRA审查重点:

Cryptocurrency Transactions: The CRA is strengthening its review of cryptocurrency transactions to ensure taxpayers report their capital gains or losses truthfully.

Self-Employment Income: The CRA is strengthening its review of "gig economy" income (e.g., Uber, Upwork) to ensure taxpayers report their income truthfully.

International Tax Compliance: The CRA is strengthening its international tax compliance review to ensure taxpayers report their offshore assets and income truthfully.

Business Expenses: The CRA will closely review the various expenses claimed by businesses to ensure that they are related to the business and reasonable.

加密货币交易: CRA正在加强对加密货币交易的审查,以确保纳税人如实申报其资本利得或损失。

自雇收入: CRA正在加强对“零工经济”收入(例如Uber、Upwork)的审查,以确保纳税人如实申报其收入。

国际税务合规: CRA正在加强对国际税务合规的审查,以确保纳税人如实申报其海外资产和收入。

商业费用: CRA会严格审查企业申报的各项费用,确保其与经营相关且合理。

Business owners need to pay special attention to and review whether the above parts have been missed or misreported during tax reporting, based on their own situation. If there are any errors, they should be corrected in a timely manner to avoid joint liability due to inspection.

企业主们需要根据自身情况,在报税时重点关注及审核以上部分是否又漏报及误报,如有错误及时纠正,避免自身被稽查而产生连带责任。

Part 2: 2024 Tax Updates and Trends

第二部分:2024年税务新规与趋势

New Policy Impact

新政策影响

新政策影响

With the economic downturn after the epidemic, entering 2024, CRA has also issued a series of new regulations on corporate income tax. The following is a summary of the relevant content:

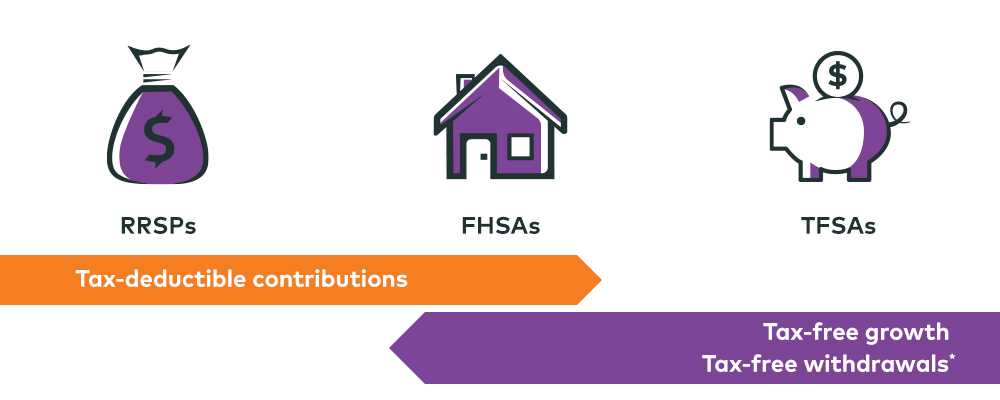

First Home Savings Account (FHSA): The FHSA is a new registered account designed to help Canadians save for their first home. Contributions to an FHSA are tax-deductible, and withdrawals from an FHSA when purchasing a home are tax-free.

Canadian Digital Services Tax (DST): The DST is a tax on large digital companies, designed to ensure that these companies pay a fair share of taxes on their revenue generated in Canada. The DST may indirectly affect small and medium-sized businesses, for example, by increasing the price of digital services.

Climate Action Incentive Payment: Residents of certain provinces may receive a Climate Action Incentive Payment to help offset the impact of carbon taxes.

Business owners can make reasonable use of and timely apply for these eligible new regulations based on their own situation, in order to optimize the tax structure to the maximum extent and reduce their own tax burden.

随着疫情之后经济形势下行,进入2024年之后,CRA也针对企业所得税出台了一系列新规,以下是相关内容的汇总速览:

首次购房储蓄账户(FHSA): FHSA是一种新的注册账户,旨在帮助加拿大人储蓄首次购房的资金。 向FHSA的供款可以抵扣所得税,并且在购房时从FHSA中提取的资金是免税的。

加拿大数字服务税(DST): DST是一项针对大型数字公司的税收,旨在确保这些公司为其在加拿大产生的收入缴纳公平的税款。需要注意的是, DST中的一些相关内容,例如通过提高数字服务的价格,可能会间接影响中小企业的应税额度计算。

气候行动激励金(Climate Action Incentive Payment): 某些省份的居民可以获得气候行动激励金,以帮助抵消碳税的影响。

企业主可以根据自身情况,合理利用并及时申请这些符合条件的现行新规,以求最大限度优化税筹结构,从而减轻自身税负。

Conclusion

结论

Tax filing is a complex but necessary task. Whether you are an individual or a business, compliant filing helps you maximize your tax refunds and avoid penalties. We recommend that you carefully read this guide and consult a professional tax advisor to ensure that you comply with all tax regulations.

税务申报是一项复杂但必要的工作。 无论是个人还是企业,合规申报都能帮助您最大化退税并避免罚款。 建议您仔细阅读本指南,并咨询专业税务人士,以确保您符合所有税务规定。

Tenace Overseal’s Department, Tangcheng Weiyi, as a professional international financial and tax compliance service provider, is an officially certified SPN service provider for AliExpress and Amazon. It has served over 20000 cross-border e-commerce enterprises, providing services including VAT number registration, product compliance registration (such as EPR, FDA), and overseas representatives (American, British, European). Our subsidiary Youling (Shenzhen) Business Consulting Co., Ltd., provides professional services such as international business registration, financial and tax auditing, cross-border architecture compliance, etc. Tenace’s wholly-owned overseas finance and taxation company and team collaborate to provide comprehensive one-stop cross-border tax management services, helping sellers ensure the compliance and security of their products, and always escorting cross-border e-commerce enterprises to go global. This includes Tenace’s local UK company, German company, US company, Singapore company, Vietnam company, Indonesian company, Australian company, UAE company, and Tenace’s Hong Kong secretary company. If you want more detailed consultation on cross-border tax and product compliance services, such as overseas finance and taxation, you can contact us through the account backend or add WeChat 15934110079. Tenace’s professional consultants will provide you with professional support and guidance.

唐诚海外作为国际财税专业会计师团队,旗下唐诚维易作为专业的国际财税合规服务商,是速卖通和亚马逊的官方认证的SPN服务商,已服务超过20000多家跨境电商企业,提供包括VAT税号服务、产品合规注册(如EPR、FDA)、海外代表人(美代、英代、欧代)。旗下优领(深圳)商务咨询有限公司提供各国工商注册及财税审计,跨境架构合规等专业服务;唐诚海外全资财税公司及团队协同作战(唐诚本土英国公司,德国公司,美国公司,新加坡公司,越南公司,印尼公司,澳大利亚公司,阿联酋公司,及唐诚香港秘书公司),提供全方位的一站式跨境税务管理服务,助力卖家确保商品的合规性和安全性,始终为跨境电商企业出海保驾护航。若您想要更详细咨询海外财税等跨境税务及产品合规服务,可通过账号后台【联系我们】或者添加微信15934110079,唐诚专业顾问将为您提供专业的支持和指导。

热门活动

热门活动

其他

其他 04-09 周四

04-09 周四

热门报告

热门报告