As the tax season approaches, business owners who establish companies in Canada must not only complete the annual corporate income tax filing for the last fiscal year but also submit the annual returns in a timely manner to ensure that their companies’ operational status remains normal. However, business owners tend to confuse annual returns with income tax filing. Indeed, this article will provide all the useful information about annual returns here for your needs. Tenace CA Inc., with 10 years of experience as a local Canadian accountant, specializes in providing specialized group services for the financial and tax needs of Chinese enterprises and overseas Chinese companies in Canada. In June 2025, we will open 5 50% discount slots for cross-border sellers, including business and tax landing. For more inquiries, please feel free to contact our tax consultants at any time. We will safeguard your Canadian journey!

随着报税季来临,在加拿大成立公司的企业主不仅需要完成财务年度企业所得税的申报,也需要及时提交年审来确保自己的公司运营状态保持正常。然而企业主们往往会将年审与所得税申报混淆,因此小编也在这里整理了关于年审的全部干货以满足您的需求。Tenace CA Inc., 为本土10年经验加拿大会计师坐镇,专门为中国企业及海外华人在加拿大公司的财税需求提供专项组服务,并且在2025年6月开放5个50%优惠名额针对跨境卖家,包括工商及财税落地,有更多咨询欢迎随时联系我们税务顾问,我们为您的加拿大远行保驾护航!

What Is an Initial Return?

什么是初始年审?

An initial return is precisely what it sounds like. This type of return is required when a company is initially created. Each jurisdiction sets its own requirements regarding the filing of initial returns. For instance, Ontario corporations must file an initial return within 60 days after incorporating to ensure their operational status, while some jurisdictions do not require initial returns to be filed at all.

In order to determine whether a jurisdiction requires initial returns, the legal team should consult the relevant corporate laws for that state. The statute will clearly explain:

Whether an initial return is required

How long the entity has to file the return

The process for return submission

Failing to file an initial return when required can create quite a headache for business owners and their legal representatives. Inaction can lead to late fees, fines, or other civil penalties. The specific penalties for failing to file a return will vary by jurisdiction.

After the initial return is filed, the business will be required to file an “annual return” in subsequent years. Once again, adherence to these filing deadlines is critical so that businesses can avoid incurring fines or other penalties.

初始年审正如它的字面意思所表达的意思一样,即当公司最初创建时,需要提交的最初申报。每个司法管辖区对提交初始申报表都有自己的要求。例如,在安省注册的企业需要在公司成立后的60天之内提交初始年审以确保自身经营合规,但其他一些司法管辖区根本不要求提交初始年审。

因此,为了确定一个司法管辖区是否需要初始申报,公司法务团队应及时了解该州的相关公司法。该法令将明确解释:

公司是否需要提交初始年审

注册多长时间以后需要提交初始年审

初始年审提交流程

未能在需要时提交初始年审可能会给企业主及其法律代表带来相当大的麻烦。不作为可能导致滞纳金、罚款或其他民事处罚。未提交纳税申报表的具体处罚因司法管辖区而异。

在提交初始申报表后,企业将被要求在随后几年提交“年度申报表”。再次强调,遵守这些提交截止日期至关重要,这样企业才能避免招致罚款或其他处罚。

What is Annual Return?

年审是什么?

In Canada, an Annual Return for corporations is a filing that must be submitted after a company’s first year of operations. Owners must submit to the appropriate government authority—either federal or provincial jurisdiction—every year. It provides basic information about the corporation, ensuring that the government’s corporate registry remains up to date. Failure to file an Annual Return can result in the corporation being struck off the registry, meaning it is dissolved and loses its legal status to operate and may be required to pay fines or penalties.

A company incorporated federally will file annual returns with Corporations Canada under the Federal Jurisdiction; a corporation incorporated provincially will be required to file its annual returns in the province where they incorporated.

在加拿大,公司的年审是公司所有人在公司成立一年之后,每年必须提交给适当的政府机构(联邦或省级管辖机构)的报告文件。它提供有关公司的基本信息,确保政府的公司注册处保持最新状态。未能提交年审可能会导致公司从登记处除名,这意味着公司解散并失去其经营的法律地位,并可能被要求支付罚款或处罚。

在联邦政府注册成立的公司将在联邦管辖范围内向加拿大公司管理局提交年审申请;在省级注册成立的公司将被要求在其注册成立的省份提交年审申请。

Federal Annual Return

联邦年审

A Corporation Governed by the Canada Business Corporations Act or the Canada Not-for-profit Corporations Act is required to file its Annual Return with Corporations Canada Every Year. The information that you provide on the Annual Return helps keep the Corporations Canada’s database of Federal Business up to date. This information will be available to the Public, and it provides investors, consumers, financial institutions, and many others with the information they need to make informed decisions about your company.

受《加拿大商业公司法》或《加拿大非营利公司法》管辖的公司每年都需要向加拿大公司局提交年审。企业所有人在年审申报表上提供的信息将有助于保持加拿大公司联邦商业数据库的最新状态。这些信息也将实时向公众开放,并为投资者、消费者、金融机构和许多其他人提供他们对该公司的运营状况做出投资决策所需的关键信息。

Ontario Annual Return

安大略省年审

The Annual Return provides information to the Ontario Government, including the mailing address, taxation year-end date, date of incorporation or amalgamation, corporation number, jurisdiction, and information about the directors and officers of the corporation, as well as the Legal name of the company. Failure to file the Annual Return could result in penalties or an Involuntary Dissolution of the company (non-compliance).

An annual return for an Ontario corporation is included in filing a corporate tax return with the Canada Revenue Agency. An Annual Return must be filed within 6 months after the Corporation’s Fiscal Year End, even if the business has not generated any income during the year.

安省公司的年审是公司所有人向安大略省政府提供信息,包括邮寄地址、税务年终日期、成立或合并日期、公司编号、管辖区、公司董事和高级职员的信息,以及公司的法定名称。未能提交年度申报表可能会导致处罚或公司非自愿解散(不合规)。

安大略省公司的年审表包含在向加拿大税务局(CRA)提交公司纳税申报表中。年审必须在公司财政年度结束后6个月内提交,即使该企业在该年度没有产生任何收入也必须按时提交。

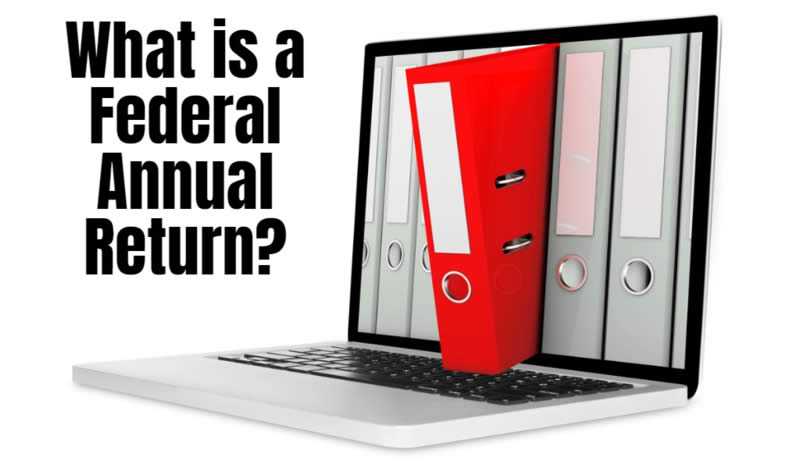

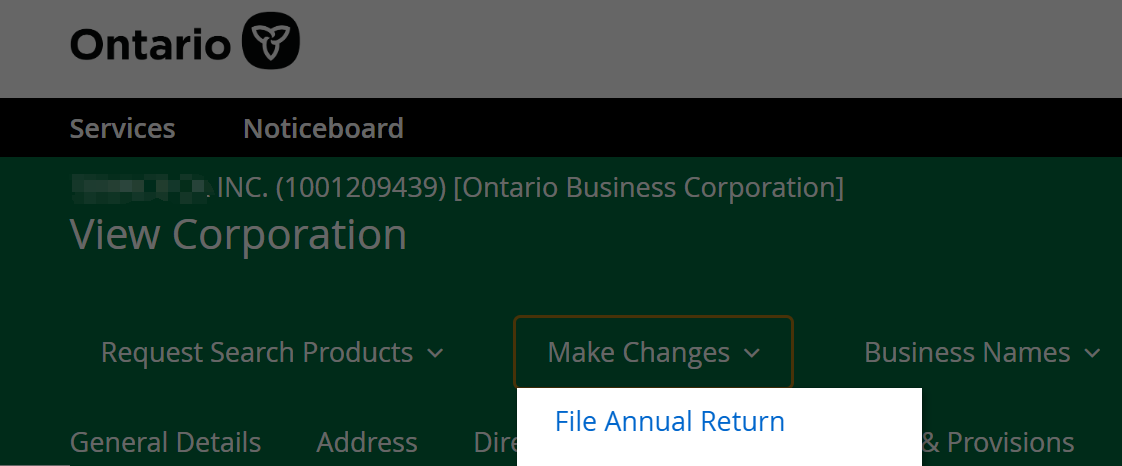

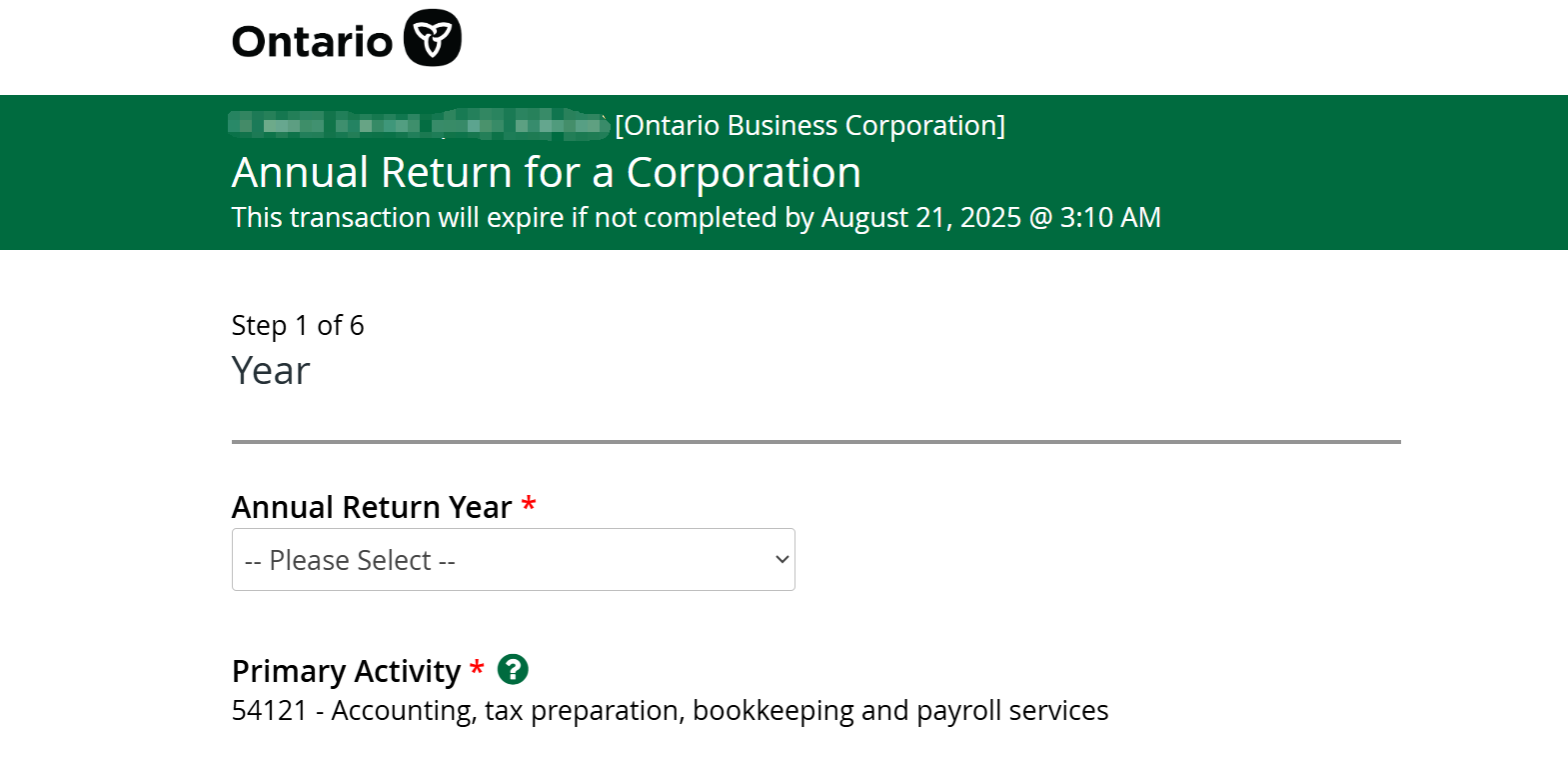

Filing my Ontario Annual Return on my own?

如何自行提交安省年审申请?

To file an Annual Return directly with the Ontario Business Registry (The Registry), you will require a Company Key as well as a My Ontario Account. You will also be requested to provide an Official email Address for the Company. There is a 10–15-day process time to register for your Company Key. Once you have this information, you can proceed to file an Annual Return directly with the Ontario Business Registry (The Registry).

如需直接向安大略省商业登记处(注册处)网站提交安省年审,则需要公司密钥和在官网注册 My Ontario Account 账户。除此以外,企业主还将被要求提供公司的官方电子邮件地址。注册您的公司密钥需要10-15天的处理时间。获得此信息后,您可以直接向安大略省商业登记处(登记处)官网提交年审申请。

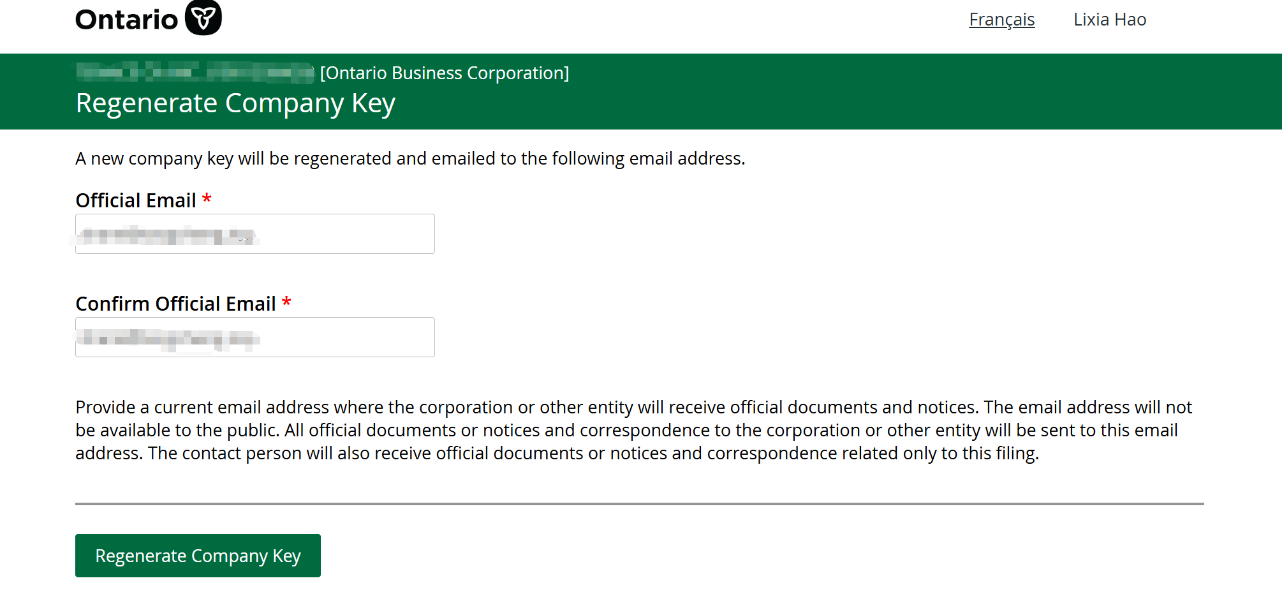

How do I get a Company Key?

企业主该如何获取公司秘钥(Company Key)?

A Company Key can be requested directly from The Registry and will be mailed to the business’s head office within 10-15 business days. If Ontario has an email account in its records, the company key could be sent to you via email. For Ontario business owners, please go to the Service Ontario website and log in to your company’s account to request your company key.

If you cannot access the email address provided on the website to login or require more information, please contact the Ontario Business Registry at 416-314-880.

公司密钥可以直接从注册处索取,并将在10-15个工作日内邮寄到企业总部。如果安省的公司注册网站记录中有您注册的电子邮件帐户,公司密钥将会通过电子邮件发送到您的注册邮箱内。对于安大略省的企业主,可以直接访问安大略省服务局网站并登录您公司的帐户界面以获取公司密钥。如您无法使用您的注册邮箱登录或是还需要更多信息,请致电416-314-880联系安省商业登记处。

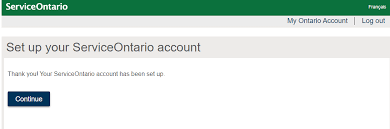

How can I set up “My Ontario Account”?

如何设置我的 My Ontario Account 账户?

My Ontario Account is a unique electronic credential that allows you to communicate securely with online Government services. You will be required to set up a USER ID and a Password.

Registering for a My Ontario Account requires a ready-to-use email address. Once you have successfully activated the account, you will need to create a profile to link your business corporation. To set up the account information properly, you can also follow the step-by-step instructions shown on the website to set up your My Ontario Account.

My Ontario Account 账户是一种独特的电子凭证,使您能够安全地与在线政府服务进行通信。您需要设置用户ID和密码。 首先,您需要一个即用型电子邮件地址来注册My Ontario帐户。成功激活帐户后,您需要创建一个个人资料来链接您的商业公司。要正确设置帐户信息,您还可以按照网站上显示的分步说明设置您的My Ontario帐户。

British Columbia Annual Report

不列颠哥伦比亚省年审

Filing a BC Annual Report

提交BC省年审

Every corporation incorporated under the British Columbia Jurisdiction, including an Unlimited Liability Company, must file an annual report. The report tells the Corporate Registry that the company is still active.

在不列颠哥伦比亚省管辖范围内成立的每家公司,包括无限责任公司,都必须提交年度报告。该报告旨在向公司注册处汇报该公司仍然处于活跃状态。

How do I file an annual report for my BC corporation on my own?

如何自行提交BC省年审申请?

To file an Annual report for your BC Corporation, you will be required to have a Corporate Online Account. There is a government fee for filing the annual report.

For more information on BC Annual Reports filing, visit their website OR Call BC Help Desk at 1-800-663-6102 or 1-877-526-1526

要为您的不列颠哥伦比亚省公司提交年度报告,您同样需要拥有一个公司在线账户,用以提交年审并且在线向政府缴费。

有关不列颠哥伦比亚省年度报告提交的更多信息,请访问其网站或致电不列颠哥伦比亚省帮助台1-800-663-6102或1-877-526-1526。

Alberta Annual Report

阿尔伯塔省年审

Filing an Alberta Annual Report

提交AB省年审

Every corporation that was incorporated under the Alberta Jurisdiction, requires to file an annual return to inform the Government that the corporation is active and in good standing.

在阿尔伯塔省管辖范围内注册成立的每家公司都需要提交年审申请,以告知政府该公司是经营活跃且信誉良好的。

How do I file an annual return for my Alberta corporation?

如何提交AB省年审申请?

You need to take your form to an authorized Alberta service provider. You will need to take:

your annual return

valid ID

fee payment

If your information meets requirements, the service provider will enter it into the Corporate Registry computer system so that you are good to go.

您需要将表格交给阿尔伯塔省授权的服务中心以完成年审,以下是您所需要提供的信息:

您的年审申请表

有效的身份证件

可用于支付费用的途径

如果您的信息符合要求,服务提供商将把您提交的年审信息输入公司注册处的计算机系统,这也意味着您已顺利完成了年审。

Important Updates in 2024

2024年度重要更新

Since January 22, 2024, corporations under the CBCA need to file information on their individuals with significant control (ISCs) at the same time as filing their annual return (within 60 days of the corporation's anniversary date).

自2024年1月22日起,CBCA管辖下的公司需要在提交年度申报表的同时(在公司周年纪念日后的60天内)提交其具有重大控制权所有人(ISC)的信息。

Frequently Asked Questions

常见问题答疑汇总

Why should I have to file an annual return?

为什么需要提交年审?

You have to file an annual return if your corporation's legal status with Corporations Canada is "active" (that is, not dissolved, discontinued or amalgamated with another corporation). You can find the status of your corporation by using the Corporations Canada online database.

This is not your income tax return. This is a corporate law requirement. It is completely separate from any filing obligations you may have with the Canada Revenue Agency (CRA).

The quickest way to file your annual return is online. To file, you need:

the date of your last annual meeting

- to know your type of corporation: distributing or non-distributing

Most corporations are non-distributing, meaning they don't sell shares to the public. Distributing corporations, on the other hand, sell shares to the public and must comply with requirements of provincial, territorial or U.S. securities laws.

to be a director, officer or authorized individual who has relevant knowledge of the corporation and has been authorized by the directors.

如果您的公司在加拿大公司的法律地位是“活跃的”(即没有解散、中止或与另一家公司合并),您必须提交年度申报表。您可以使用加拿大公司在线数据库查找您公司的状态。

值得注意的事,这并不是你的企业所得税申报表。而是公司法的要求所完成的步骤。因此它与您在加拿大税务局(CRA)的任何申报义务应当完全分开。

提交年度申报表的最快方式是官网在线提交。要完成该操作,您需要提供:

您上次年度会议的日期

了解你的公司类型:分销或非分销

大多数公司都是非分销的,这意味着他们不向公众出售股票。另一方面,分销公司向公众出售股票,必须遵守省、地区或美国证券法的要求。

担任董事、高级职员或授权个人,对公司有相关了解,并经董事授权。

What is the deadline for filing my annual return?

如何获悉我的年审截止日期?

The deadline for filing an annual return is within the 60 days following a corporation's anniversary date. The anniversary date is the date your corporation incorporated, amalgamated or continued under the CBCA. You do not file for the year the corporation was incorporated, amalgamated or continued.

The date can be found on your corporation's Certificate of Incorporation, Amalgamation or Continuance. You can also find your anniversary date on Corporations Canada's online database.

企业主提交年审的截止日期应为公司成立周年纪念日后的60天内。周年纪念日是指贵公司根据CBCA成立、合并或存续的日期。您没有申报公司成立、合并或存续的年份。

该日期可以在贵公司的公司注册证书、合并证书或存续证书上找到。您还可以在加拿大公司的在线数据库中找到您的周年纪念日。

If I am not currently operating my corporation, do I still have to file?

如果我目前没有经营公司,我还需要提交年审申请吗?

If your corporation's legal status is "active" (that is not dissolved, discontinued or amalgamated with another corporation), you are still obligated to file. You can find the status of your corporation by using the Corporations Canada online database.

If you are no longer operating the corporation and want to dissolve your corporation (that is, legally terminate its existence), refer to Dissolving a Business Corporation.

如果您的公司的法定经营状态是“活跃的”(即没有解散、中止或与另一家公司合并),那么您作为所有人仍然有义务提交年审。您可以使用加拿大公司在线数据库查找您公司的状态。

如果您不再经营公司并希望解散公司(即合法终止其存在),请详询解散商业公司的相关内容。

If my corporation is small, do I still have to file every year?

我的公司规模很小,还需要每年年审吗?

Yes. Big or small, every corporation is legally obligated to file. It is important that the government have accurate and up-to-date information about every corporation.

对。无论大小,每个公司都有法律义务提交文件。这对加拿大政府掌握每家公司的准确和最新信息非常重要。

What if we did not hold an annual meeting of shareholders?

如果我们没有召开股东年度大会该怎么办?

The CBCA requires that all corporations, big and small, hold at least one annual meeting of shareholders every year. At this meeting, the shareholders are required to:

Consider the financial statements

Consider the auditor's report, if any

Appoint the auditor, if required

Elect directors, if necessary.

For corporations with only one or a few shareholders, it may be more practical to prepare a written resolution rather than to hold a formal meeting. A written resolution is a written record of decisions made that is signed by all of the shareholders entitled to vote. If you use a written resolution instead of holding an annual meeting, provide the date the resolution was signed on the annual return.

CBCA要求所有公司,无论大小,每年至少举行一次股东年会。本次会议要求股东:

考量公司财务报表

考量公司审计报告(如有)

如有需要,任命审计员

必要时选举董事。

但是对于只有一个或少数股东的公司来说,准备一份书面决议可能比举行正式会议更实际。书面决议是由所有有权投票的股东签署的决定的书面记录。如果您使用书面决议而不是举行年度会议,请在年度申报表上提供决议的签署日期。

What if I am late filing my annual return?

迟交了年审会怎么样?

If you do not file your annual return on time, the status of your corporation’s annual filings in our online database of federal corporations will be displayed as “overdue,” and your corporation will not be able to obtain a Certificate of Compliance.

如果您没有按时提交年度申报表,您公司在我们的联邦公司在线数据库中的年度申报状态将显示为“逾期”,您的公司将无法获得合规证书。

Can I file early (before my anniversary date)?

可以提前提交年审吗?

No. The information on the annual return must reflect the corporation's situation on its anniversary date of each year of filing. For example, if your corporation was incorporated under the CBCA on July 12, the annual return is due within 60 days of July 12 the next year and every year after that. The information appearing on the return should reflect the corporation's situation on July 12 of each year of filing.

If you file the annual return before the anniversary date, it will not be accepted.

不可以。年度申报表上的信息必须反映公司在每年申报周年日的情况。例如,如果您的公司是在7月12日根据CBCA注册成立的,则年度申报表应在次年7月12日起60天内提交,并在此后每年提交。申报表上显示的信息应反映公司在每年7月12日的情况。

如果您在周年纪念日之前提交年度申报表,将不被接受。

How will I know when it is time to file?

如何得知应该何时提交申请?

Corporations Canada will send a personalized reminder notice when your annual return is due to be filed. If you do not file on time, we will send a default notice.

The reminder notice and default notice will be sent by email if you have subscribed to the Annual Return Reminder Emails service. If you have not subscribed to this service, you will receive these notices by post at either the corporation's registered office address or at any additional address you may have provided to Corporations Canada.

加拿大公司管理局将在您的年审即将到期时发送个性化提醒通知。如果您没有按时提交,则管理局将发送默认通知。

如果您已订阅官网提供的周年申报提醒电子邮件服务,则官方将通过电子邮件发送提醒通知和违约通知。如果您尚未订阅此服务,您将通过邮寄方式在公司的注册办公地址或您可能向加拿大公司提供的任何其他地址收到这些通知。

What if I don't file?

不提交年审会有什么后果?

Your corporation may be dissolved if it fails to file its annual returns. CBCA are obligated to ensure that corporate information is up to date. If your corporation is not filing its annual returns, officials will assume that it is not operating, and they will take steps to dissolve it (that is legally end its existence). Dissolution can have serious repercussions, including not having the legal capacity to conduct business.

CBCA do recognize that some corporations, especially small businesses, may not always be aware of these filing requirements. So, while the law allows them to dissolve a corporation after one year of non-filing, it is the practical policy to only dissolve a corporation when it has not filed for two years. Also, if your corporation is in danger of being dissolved, they will send a final notice warning of the pending dissolution and providing an additional 120 days to file the required annual returns. This final notice will be sent by post to all valid addresses they have on file (including current directors' addresses). Also, the name of the corporation to be dissolved will be published in the Corporations Canada Monthly Transactions.

如果你的公司未能提交年审,那么它将可能会被解散,因为CBSA有义务确保公司信息是即时更新的。因此如果你的公司没有及时提交年审,官方将视为它没有实际运营,也将采取措施解散它(即依法终止其存在)。解散可能会产生严重影响,包括没有开展业务的法律能力。

但CBCA同时也承认一些公司,尤其是小型企业,可能并不总是意识到这些备案要求。因此,虽然法律允许他们在一年未提交申请后解散公司,但实际的政策是只有在公司两年未提交申请时才解散公司。此外,如果您的公司有解散的危险,他们将发出最终通知,警告即将解散,并提供额外的120天时间提交所需的年审。此最终通知将通过邮寄方式发送至存档的所有有效地址(包括现任董事的地址)。此外,待解散公司的名称也将在《加拿大公司月度交易》网站上公开公布。

Conclusions

结语

Tenace Overseal’s Department, Tangcheng Weiyi, as a professional international financial and tax compliance service provider, is an officially certified SPN service provider for AliExpress and Amazon. It has served over 20000 cross-border e-commerce enterprises, providing services including VAT number registration, product compliance registration (such as EPR, FDA), and overseas representatives (American, British, European). Our subsidiary Youling (Shenzhen) Business Consulting Co., Ltd., provides professional services such as international business registration, financial and tax auditing, cross-border architecture compliance, etc. Tenace’s wholly-owned overseas finance and taxation company and team collaborate to provide comprehensive one-stop cross-border tax management services, helping sellers ensure the compliance and security of their products, and always escorting cross-border e-commerce enterprises to go global. This includes Tenace’s local UK company, German company, US company, Singapore company, Vietnam company, Indonesian company, Australian company, UAE company, and Tenace’s Hong Kong secretary company. If you want more detailed consultation on cross-border tax and product compliance services, such as overseas finance and taxation, you can contact us through the account backend or add WeChat 15934110079. Tenace’s professional consultants will provide you with professional support and guidance.

唐诚海外作为国际财税专业会计师团队,旗下唐诚维易作为专业的国际财税合规服务商,是速卖通和亚马逊的官方认证的SPN服务商,已服务超过20000多家跨境电商企业,提供包括VAT税号服务、产品合规注册(如EPR、FDA)、海外代表人(美代、英代、欧代)。旗下优领(深圳)商务咨询有限公司提供各国工商注册及财税审计,跨境架构合规等专业服务;唐诚海外全资财税公司及团队协同作战(唐诚本土英国公司,德国公司,美国公司,新加坡公司,越南公司,印尼公司,澳大利亚公司,阿联酋公司,及唐诚香港秘书公司),提供全方位的一站式跨境税务管理服务,助力卖家确保商品的合规性和安全性,始终为跨境电商企业出海保驾护航。若您想要更详细咨询海外财税等跨境税务及产品合规服务,可通过账号后台【联系我们】或者添加微信15934110079,唐诚专业顾问将为您提供专业的支持和指导。

热门活动

热门活动

其他

其他 04-09 周四

04-09 周四

热门报告

热门报告